Government launches ‘Operation Clean Money’ website, says ‘no longer safe to deal with excessive cash’

Income Tax Department (ITD) has initiated Operation Clean Money, today. Initial phase of the operation involves e-verification of large cash deposits made during 9th November to 30th December 2016. Data analytics has been used for comparing the demonetisation data with information in ITD databases. In the first batch, around 18 lakh persons have been identified in whose case, cash transactions do not appear to be in line with the tax payer’s profile.

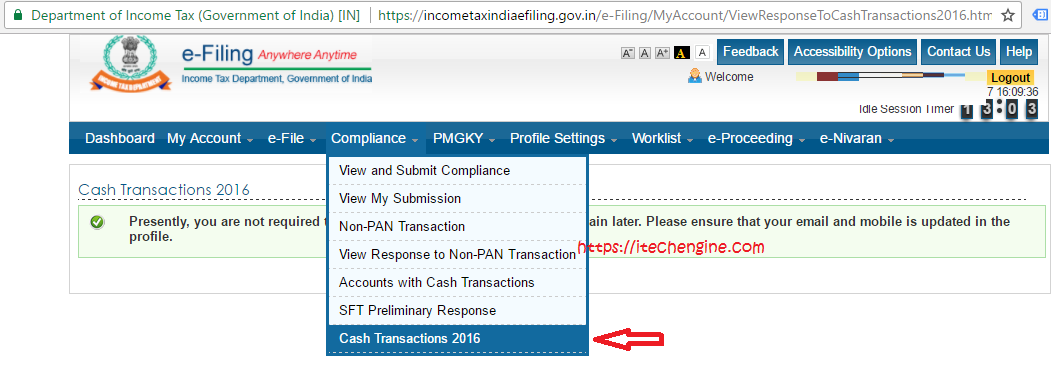

ITD has enabled online verification of these transactions to reduce compliance cost for the taxpayers while optimising its resources. The information in respect of these cases is being made available in the e-filing window of the PAN holder (after log in) at the portal https://incometaxindiaefiling.gov.in. The PAN holder can view the information using the link “Cash Transactions 2016” under “Compliance” section of the portal. The taxpayer will be able to submit online explanation without any need to visit Income Tax office.

Email and SMS will also be sent to the taxpayers for submitting online response on the e-filing portal. Taxpayers who are not yet registered on the e-filing portal (at https://incometaxindiaefiling.gov.in) should register by clicking on the ‘Register Yourself’ link. Registered taxpayers should verify and update their email address and mobile number on the e-filing portal to receive electronic communication.

A detailed user guide and quick reference guide is available on the portal to assist the taxpayer in submitting online response. In case of any difficulty in submitting on line response, help desk at 1800 4250 0025 may be contacted.

How to check Cash Transactions you made?

Logon to https://incometaxindiaefiling.gov.in. – The PAN holder can view the information using the link “Cash Transactions 2016” under “Compliance” section of the portal.